AccionMAD 15 XII Action Art Festival

Nov 2, 2015

calendar

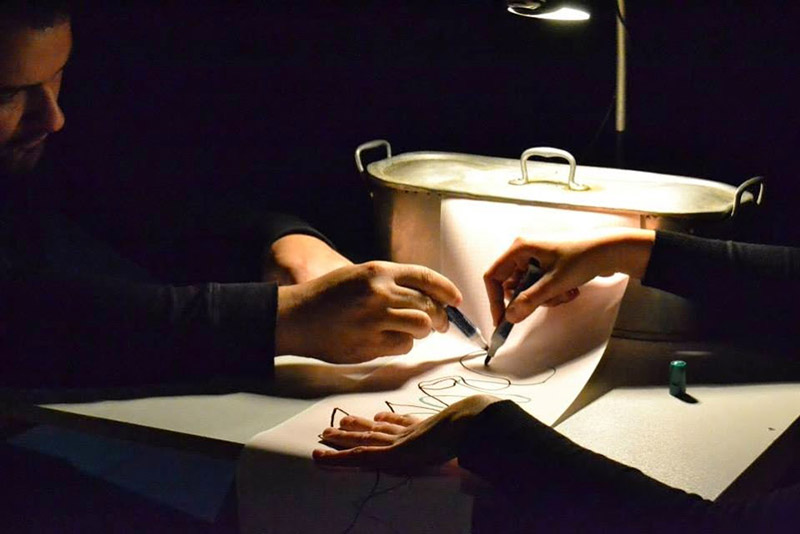

In 2003 they decided to fill the void that was in the Madrid scene on issues as performance and action art, and since then, AcciónMAD! It is the annual meeting of reference for amateurs and professionals of this hybrid, independent and autonomous genre of visual arts.

Since its origins, AcciónMAD! has always covered a wide geographic spectrum and this year especially, has gone from being a focused in November to be a live programming throughout the year in different places and countries, based on collaborations and projects of diverse nature but always showing special attention to the work of young artists and visibility of women artists whose contribution to action art and performance has always been outstanding.

This November, from 3 to 28, the main meeting of AcciónMAD! is held in multiple locations such as the Reina Sofia Museum, the School of Arts and Spectacles TAI, or the Complutense University - all in Madrid - and the Museum Vostell Malpartida de Caceres.

Directed by Nieves Correa (we had the opportunity to see her fantastic performance in the last edition of Art Madrid 2015), coordinated by Yolanda Perez and with the collaboration, among others, of Abel Loureda, Action!MAD organizes throughout the year courses, workshops, round tables, conferences, artist residencies and exhibitions for the public space. In addition, since 2008 they have a section dedicated to the younger experiences: "Space Fragile", organized in collaboration with Faculties of Fine Arts in Spain and Europe.

AcciónMAD! seeks to highlight the versatility and expressive depth of the performance art, hybrid genre that includes many very different forms and practices but with some constants: the artist is the protagonist of the play and usually implies a strong relationship with his body as a tool for action, the relationship with the audience does not follow the standard roles player/viewer and aims to involve the public, play and interaction use to replace the actual narration and often use public space or spaces unrelated with art for their actions... Performance also has an special concept of time, completely flexible because every action responds to a very exceptional nature and its duration varies as much as the message you want to convey.

By AcciónMAD! They have passed artists like Isidoro Valcarcel Medina (National Prize of Plastic Arts of Spain in 2007, Velázquez 2015 Award), Nacho Criado (Gold Medal for Merit in Fine Arts in 2008 and the National Prize of Plastic Arts of Spain in 2009) Esther Ferrer (National Prize of Plastic Arts of Spain in 2008) and Concha Jerez (Gold Medal for Merit in Fine Arts in 2011).

Take a glance to the complete agenda: Programa Completo de AcciónMAD!15.