THE PHENOMENON OF THE SHARK AND THE FISHES BANK

Sep 12, 2019

Breaking News

The art market is often referred to as a separate sector of the economy that develops in isolation from other business areas. A part of this approach is true: art is not just any product because, whether we talk about antiques or contemporary artworks, they all have unique characteristics, they represent the spirit of their creator, they convey sensations to the viewer, they enclose emotion, passion and a critical purpose not present in any other everyday object. But the other part of this statement is not correct: the art market also suffers from the economic setbacks that affect the rest of the commercial spheres, perhaps the difference is that, due to the exclusivity of this sector, it is not so evident to everyone.

By historical and economic tradition, along with some other factors such as the lower legal restrictions or the speed of bureaucracy, the leading art world markets locate in London, New York, Paris, Milan and Geneva, and more recently, Hong Kong. Spain's position does not exceed a low 1%, a percentage that grows by one point if we stick to Europe. Despite this, we must not underestimate the importance of our national market, which progressively incorporated more professionals, absorbing artists, generating buyers and positioning Spanish contemporary art, with an estimated growth of 42% between 2009 and 2016. In this evolution, some authors point out that we have a recent democracy, compared with surrounding countries, and that before the Reina Sofía Museum was inaugurated, there was no other centre in the country dedicated to contemporary art.

But just when we sat on the top of the wave, a few years after entering the new millennium, a deep economic crisis broke out and shook all the foundations of the system. Art and culture, of course, were the first to suffer the cuts. The castle of prosperity falters, capital flows cut, goodbye to investment, languid farewell to the institutional purchases and bank collections. How does this always resilient sector overcome?

Without a doubt, the crisis has marked a before and after in many economic areas. The paralysis of investments led many businesses to reinvent themselves and resurface from their ashes like the Phoenix. The same applies to the art market. But the result of this readjustment differs quite a lot from the previous scheme, because, not only the capital reduction counts but also the entry into the digital world and a generational change that has led to a transformation in consumer habits and the way of approaching art. After those years of uncertainty, a new model emerges in which people no longer visit the galleries, there is art of online consultation, travel and tours are reserved for large events, concentrated in art fairs, new satellite proposals arise, with virtual galleries, minimal spaces, online sales, and a withdrawal of proposals.

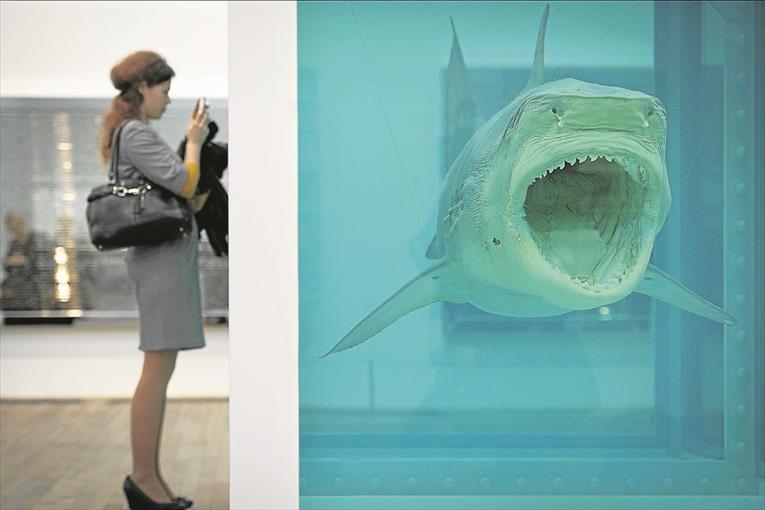

The paradox of this stage started in the second decade of the 2000s is the distance created between types of galleries. In a fully digitised environment, the contours between professional profiles blur. Now it is not only the gallery owner who promotes the artist but the artist himself who invests efforts to gain presence, which leads to a weakening of roles. And amid this tidal wave of events, a phenomenon is gaining weight progressively: the great galleries, successful survivors of the debacle, expand and grow until almost completely assimilate to a museum. From this triumphant position, they are the only ones that can afford the maintenance of large spaces, cover the costs of production of work, participate in the most renowned fairs and continue to open branches abroad. With this dynamic, it happens that these galleries have an irresistible power of attraction over the most promising artists, perhaps discovered by a local gallery now unable to guarantee the promotion to which the creators aspire. Thus, the art world pivots in a sea of events, where the great white shark lives with tiny fish, but they all contribute to maintaining the ecosystem.

Therefore, what happens in the art market, little or nothing is far from what happens in other economic sectors. The influence of globalisation and the uncontrollable tendency to create giants capable of supporting future attacks establishes a network of small businesses that survive in the shadow of those few chosen. This circumstance seems to polarise the sector in two large planes: that of contemporary astronomical price artists who have created real art factories, produce on an industrial scale and are represented by the most famous galleries, and that of artists who are best known at local level, that can modestly live from their work and are distributed, when they have an international presence, between different small galleries. And this pattern is replicated in all commercial areas. The shark and the bank of fishes. With this simple metaphor, we portray one of the most repeated patterns in our capitalist society that applies to the entire industry, whether we talk about fashion, cars or food. That is why the millennial generation has begun to explore alternative models of galleries, with more attention on the artistic quality of young talents and less weight in the exhibition space: 21st-century galleries that open their doors to the future.